Building the Saab brand: BMW and other factors

Introduction

This article examines some of the issues surrounding the Saab brand. A nationally representative survey of 112 respondents in the UK (Saab’s most lucrative European market outside of Sweden) and existing literature is used in support of the analysis.

BMW’s partnership with Saab, announced last month, drew a large amount of positive press attention for Saab. As the larger partner BMW has little to worry about in terms of the effect on its brand equity, however the Saab brand is in a more precarious position.

Saab, a small Swedish luxury car brand was – as far as the media and many industry analysts were concerned – about to take its rightful place as a historical footnote at the end of 2009. At the eleventh hour Saab’s owners (General Motors since the year 2000) found a buyer just as they were winding the operation down. Since then the brand has gradually begun to right itself with a fresh take on its niche brand strategy.

Saab’s brand heritage

Brand equity is an intangible asset, it only exists in the minds of the consumers within a defined market, but it has a very concrete impact on behavior and thus the bottom line. Saab’s particular form of brand equity used to be expressed in a loyal, almost fanatical customer base – conquest sales were not the way the brand survived. However as GM made its presence felt in the 2000s, Saabs repeat-purchase rates dropped. Repeat-purchase rates were: 35.5%, 33.4% and 9% in 2004, 2006 and 2009 respectively (source: JD Powers).

Even though repeat-purchase loyalty flagged, the emotional attachment continued – even going as far as protests on the streets. As a near bankrupt General Motors started to close or sell many of its brands in 2009 (Hummer, Pontiac, Saab and Saturn) Saab loyalists were the only ones prepared to take to the streets in a global outcry against GM’s decision. Saab employees also displayed unusual loyalty, voluntarily working on projects even when there was no budget available.

Saab’s attraction seems to be due to two major factors: contrarian engineering and relatively low sales figures. Even though Saab’s products have always fallen into segments typically populated by ‘mass produced’ cars – it was and still is a rare sight on the roads. The fact that it is only popular amongst a small niche of buyers, seems to be itself attractive to the niche (5). The community is small enough in fact, that it has developed its own rituals, such as signaling other Saab drivers on the road8 or helping stranded Saab drivers – even though they were total strangers.

So paradoxically, success for Saab has meant not being too successful. Saab has never sold more than 140,000 units in any one year of its entire existence (2).

What needs to be done to strengthen the Saab brand within its niche?

According to imminent brand theorist David Aaker (3), there are four major processes that build a strong brand:

1.) Ensuring the organisational structure and processes support the brand

A major failing of GM’s management was not ensuring someone senior enough cared about the brand. GM tended to leave Saab to lower level managers who never stayed long enough to execute a coherent strategy. The message conveyed to customers was one of “We don’t really care, Saab customers make-up a small component of our total sales”.

Under new ownership circumstances couldn’t be more different. The new CEO, Dutchman Victor Muller, has returned the ‘small’ feel to the brand with his refreshing management style. The antithesis of a GM CEO: 1.) He himself pilots Saab cars in races, 2.) spontaneously shows new designs for Saab cars to the media on his iPod and 3.) says what he thinks without much regard for tact or PR spin. The absence of formality and procedure reinforces the image of a small company which is open to dialogue with its customer base.

2.) Ensure that the brand architecture is correct

In the past this was poorly managed – evidence of this being the media’s constant confusion between Saab and other GM brand’s underpinnings. Many journalists referred to Saabs (incorrectly) as Opels/Vauxhalls with Saab bodies. GM did little to counter this blurring, resulting in a poorly defined brand architecture.

Saab risks a similar blurring in its relationship with BMW.

BMW in contrast to Saab is an ingenious ‘victim’ of its own success – a luxury brand which is not exclusive. BMW has managed to get away with this on the strength of its engineering, emphasis on quality (6) and sound pricing strategy. Added to this is brand purity – BMW is still BMW from the ground up, it is not just a sub-brand in a corporate empire.

So, fortunately, BMW has better brand cache than GM but Saab still needs to ensure that a Saab both looks and behaves like a Saab. Saab needs to benefit from BMW equity without diluting its own equity.

Saab will have to invest its limited engineering and promotional budget into actively differentiating Saab from BMW and its other competitors – in a functional/meaningful way in order to avoid being overshadowed by the larger brand.

3.) Defining the brand positioning crisply

Saabs strengths were and still are poorly communicated. The result is consumers often don’t include these strengths in their mental positioning of Saab.

Some examples:

Safety leadership was claimed by Volvo, in-spite of the fact that Saab did just as well in the laboratories (NCAP) and better than Volvo in real life (IIHS injury data). A lack of advertising spend left this strength largely unknown, meaning it was wasted as a brand differentiator and not translated in equity.

Unusual performance quirks, such as exceptional mid-range acceleration, making over-taking and moving into traffic a breeze. This positioning point is under threat as a unique differentiator as competitors have introduced turbo charging at the entry level.

Quality, quality, quality. Saab emphasized quality under the skin and spent large amounts of cash engineering the engines, suspensions and crash structures. However they under-spent on interiors, leaving them lagging in the perceived quality stakes. Going forward they will need to keep the accountants out of the passenger cabin.

Styling differentiators, such as the characteristic Saab dashboards, ignition location and the clamshell bonnet were watered down by GM. These aspects will need to be emphasized again, but without falling into the trap Jaguar fell into by allowing too many retro styling cues.

Perceived value for money. Saab claims it is positioning on price at Audi levels – slightly below BMW and Mercedes. However Saab made the mistake of leaving out its entry level variants when launching the new 95 model this year. This led to some industry commentators claiming the Saab was over-priced.10 Of course under-pricing would be just as bad.

In this area, Saab could do no better than to learn from BMW South Africa, who for many years have managed to offer discounted pricing without being perceived to be doing so – the discount being disguised in the form of reduced interest rates.

4.) Brand building programmes

Firstly, Saab needs to ensure it has the right target positioning – i.e. where it wants to be in the minds of potential customers. Doing this means marketing research: Quantifying the value of alternative brand positionings and ensuring the right segments find the positioning appealing. While most automotive companies face the temptation of appealing to the more valuable segments in terms of volume and spend, Saab’s financial strategy allows it to avoid this. By pandering to the tastes of a core segment of loyal buyers, Saab will ensure it has a steady stream of repeat purchases in future.

Secondly, ensuring the actual brand positioning matches the ideal brand positioning means spending the required advertising and PR money, and aligning other functional areas in the organisation in support of this positioning. Everyone, from the design department to the dealer network need to reinforce the positioning of the brand.

Conducting ongoing brand tracking surveys will help managers gauge whether actions taken result in the actual positioning coming closer to the ideal positioning. Raw brand awareness also needs to be tracked.

How is the ‘new’ Saab performing so far?

In the past, Saab was underfunded in certain key areas in the name of cost cutting, only for this to backfire by reducing brand equity and thus sales. There are two main areas which Saab needs to resolve in its brand building efforts: Interior quality perceptions and communication.

Interior quality perceptions

Time and again reviewers pointed out flaws with the interiors (and continue to do so with the new 95) while GM did little in response.

The survey results provide an indication that Saab’s interior problems are having a very real impact on Saab’s brand equity. It is not just an issue noted by journalists, it is also a perception shared by the broader public. Of all the areas measured, this is the area where Saab lags Audi most.

Note: Generally brand surveys are restricted to a particular group, such as a specific segment of automotive customers. It was decided that since Saab’s target segments are in a state of flux at present, a broader view of the entire nation would be more useful (16 years and older).

Marketing communication issues

As can be seen on the chart, the general public also seem unaware of Saab’s leading position on key differentiators such as safety. Ultimately this can be blamed on inadequate communication, not only with the public but also with the motoring media.

What can be done to build Saab’s brand equity?

Building brand equity costs money. Balancing financial viability with engineering and brand-building investment, will continue to be a challenge. While Saab, in past decades, developed most of its components from scratch, the R&D investments required to produce the vastly more complex cars of today makes this impossible given Saab’s sales volumes. To solve this dilemma, Saab is continuing the strategy of using off-shelf components (hence the BMW engine partnership) to reduce overheads. In fact, Saab has been structured by its new owners to have such low overheads that it is likely to break even at a relatively-small volume of 75,000 units (4).

For this partnership to work though, Saab will have to avoid making the same mistakes again. Off-the shelf components must be invisible or modified to take on Saabish qualities. Most essentially Saab needs to ensure that perceived quality is balanced against price perceptions.

So far, if the new 95 is anything to go by, Saab still seems only vaguely aware of how critical quality perceptions are. Even though Saab’s Swedish factory was having problems obtaining a critical dashboard panel from a supplier, Saab still launched the new 95 – resorting to a stop gap grey panel – which drew intense criticism from motoring journalists which will no doubt contribute to perceptions of poor quality amongst consumers. Price perceptions were also not managed as the more expensive models came on the market first, leading at least one analyst to conclude that the 95 was hopelessly over-priced (10). Given that you most of the press attention at launch – this was a significant blunder.

Action steps:

1. Guard the brand architecture and prevent confusion with larger partners such as BMW. Saab’s own internal engineering independence needs to be maintained – especially in areas that really differentiate the brand. These points of differentiation need to not only make Saab ‘different’ in terms of performance and interior characteristics, but also need to have practical value. Saab’s new diesel – which achieves industry leading CO2 levels – is a case in point. Saab need to ensure the current advertising blitz claims this as its own engineering achievement (from what I have seen so far, this has not been done in a clear enough manner).

2. Ensure Saab’s have a well-defined brand positioning ideal on paper – and that the gap between the ideal and what consumers actually perceive is monitored rigorously (monthly brand-tracking surveys). Managing quality and value-for-money perceptions on the basis of this tracking data is key to ensuring that the brand positioning actually improves.

3. Only spend money on brand building campaigns that actually communicate the brand’s unique positioning – scrap the rest. Saab can’t afford bland ‘wallpaper’ advertising just for the sake of building awareness. Any product advantage is worthless unless potential customers know about it. As can be seen below, Saab’s advertising has been generating some awareness in the UK of late, however it is far outpaced by its main rivals Audi and Volvo.

4. Enable Saab’s existing brand advocates – give them tools to promote the brand further (e.g. brochures or test drive invites). Saab has an unusually loyal core of brand advocates who promote the brand through word of mouth and through numerous blogs (numerous given Saab’s small market share) (7).

5. Saab should utilise any opportunities that allow other strong brands to ‘rub-off’ on Saab’s brand equity. The current BMW arrangement is an obvious example. Another alternative that does not yet seem to be under consideration is involving Saab’s automotive’s original owner – Saab aerospace – in the design of one or two components. Re-establishing the connection with the fighter jet maker can’t be a bad idea given Saab’s aeronautical heritage and need to communicate engineering prowess.

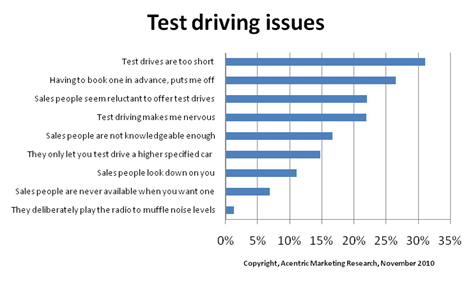

6. Test drives. The survey results also revealed some key issues amongst those who test drive new cars. Saab should aim to counter these issues, as test driving is critical to improving perceptions. The three main issues are: 1.) The short duration of test drives, 2.) having to book in advance and 3.) reluctance on the part of dealers to offer test drives.

Saab needs to make sure cars are available at a moments notice. Secondly Saab needs to monitor sales people to ensure they are actually offering test drives (mystery shopping is an ideal way to do this).

Saab should not only target today’s most lucrative segments when offering test drives. Targeting the youth, especially those who are likely to buy a Saab in later years (e.g. university students studying courses with high income potential and young professionals) may make sense. Given their probable comparison set, these groups are more likely to find that the cars exceed their expectations and are so more likely to provide positive word of mouth now and hopefully future sales. They may also be an important influence on the decisions made by parents and significant others.

References and notes

1. “Spyker Cars N.V.: SPYKER CARS N.V. (including SAAB AUTOMOBILE A.B.) REPORTS ITS SEMI-ANNUAL REPORT 2010”. Web: www.reuters.com.

2. “Saab Automobile’s Global Sales Volume 1947-2007” (2008). Web: www.saabhistory.com.

3. Aaker, DA and Joachimsthaler E (2000) “Brand Leadership”, The Free Press: New York.

4. Stevenson, R (2010), “Spyker aims to boost Saab production 18%”, Business Day, 29 September.

5. Anecdotal evidence from blog entries.

6. Bold, B. (2004). “News Analysis: Is BMW risking brand suicide?”, Marketing, April 21.

7. An interesting example of this phenomenon is a blog run by a chartered accountant, Steven Wade who seems to spend most of his spare time promoting the brand. Web: www.saabsunited.com.

8. O. Aykac, D. Selcen, (2007). “Identification in Hyper-Loyalty Brand Communities” (2007). MAKING OF CULT BRANDS, Swapna Gopalan, ed., ICFAI Press: Andhra Pradesh, India, 2007. Available at SSRN: http://ssrn.com/abstract=1363795

9. Hjalte, S. & Larsson, S. (2004) “Managing customer loyalty in the automotive industry: Two case studies”, Masters thesis. Lulea University of Technology. Web: http://epubl.luth.se/1404-5508/2004/074/LTU-SHU-EX-04074-SE.pdf

10. Kinnander, O. (2010).“Volvo, Saab Need More Than `Me-Too’ Luxury to Beat BMW”. Bloomber, 23 September. Web: http://www.bloomberg.com/news/2010-09-22/volvo-saab-need-more-than-me-too-german-luxury-to-beat-bmw.html